Trending Insights: Digitization of the Commercial Insurance Industry

- Oct 7, 2025

- 7 min read

Updated: Nov 28, 2025

Preparing for a Data-Driven Future

To download the full report, click below

Factors Driving Business Digitization

The push for greater digitization in the industry is driven not just by the emergence of new technologies, but also by the increasingly complex risk landscape they create, rising consumer expectations, and the significant financial consequences businesses face if they fail to embrace digital transformation.

Complex Risk Landscape: Why Traditional Actuarial Models Fall Short

The global commercial risk environment has become more volatile and interconnected than ever before. Traditional actuarial models — built primarily on historical loss data and static assumptions — are struggling to capture the realities of modern risk. Today’s businesses face exposures that evolve too quickly, cut across multiple geographies, and often lack the historical data needed for reliable statistical modeling.

One of the most pressing examples is cyber risk. Traditional actuarial approaches depend on long-term loss histories to predict frequency and severity, but cyber threats evolve far faster than historical models can keep up. New attack vectors, ransomware tactics, and systemic vulnerabilities — such as those targeting cloud providers — mean that past losses are a poor predictor of future risk.

SeCAP, a captive insurance company that focuses on cyber security and risk insurance, notes that the lack of credible data combined with rapidly changing technology makes cyber one of the hardest lines for insurers to price accurately using classical models (SePAC, 2024).

Without a robust data foundation, traditional actuarial models are left trying to make predictions in a data-poor environment, which undermines their accuracy and reliability (SeCAP, 2024)

Consumer Demand Driving Digital Transformation

Consumer demand is one of the leading motivators for the digitization of business in the global insurance industry.

A 2025 survey revealed that 64% of consumers would consider switching insurers for an improved digital experience - a number that seriously highlights the critical role of increasing digitization, specifically in the areas of customer retention and acquisition.

However, it is not simply about providing consumers with more digital options (such as, for example, being able to fill out an insurance quote form online as opposed to making a phone call), which is already very 1995; instead, consumers are demanding more seamless, efficient, and personalized services.

For companies who haven’t fully adopted digitization, today’s customer demands may seem conflicting: Consumers want more seamless, efficient, and personalized services - totally contactless.

However, for many other industries, this form of contactless digitization has been a cornerstone of their business strategies for years. So, while the majority of the non-insurance industries have accepted, adopted, and implemented digital services, the insurance industry has not - but now customers are demanding it.

According to Prosci, a leader in change management strategies, there are a number of things consumers are looking for in this semi-self-serve landscape, such as mobile-first platforms

Tailored and personalized engagement - traditional, hybrid, or fully digital.

In 2025, 48% of consumers are seeking a hybrid digital engagement model while 15% are seeking a fully, contactless digital engagement model (Insurity, 2024)

Cost Pressures

Company digitization and automation can present some pretty significant cost savings. In fact, Bain & Company (Digitalization in Insurance: The Multibillion Dollar Opportunity, 2017) state that digitalization presents an immense opportunity whereby the impact on both revenues and costs can be enormous.

“A prototypical P&C insurer in Germany that implemented these technologies could increase its revenues by up to 28% within five years, reduce claims payouts by as much 19% and cut policy administration costs by as much as 72%,” says Bain & Company (Bain & Company, 2017).

But There Are Drawbacks

The problems with digitization presents in the costs of the initial investment and with an ever-evolving insurance environment, the time and money that goes into digitization feels momentous. Companies who are barely keeping their head above water will find it difficult to dedicate time and money to digitally revolutionizing their business - regardless of the possible benefits.

The transition from legacy systems to modern digital platforms requires substantial upfront investment. This includes costs for new software, cloud infrastructure, and integration of existing data into new systems.

Such investments are essential for automating processes like underwriting and claims management, which can lead to long-term savings and improved efficiency.

In addition to the upfront costs, there are ongoing costs and considerations that must be taken into account, as well, such as ongoing maintenance and additional operating expenses of these new systems, plus the acquisition of professionals skilled in areas such as data analytics, cybersecurity, and AI.

And lastly, businesses will need to organize and implement regulatory compliance while learning how to navigate this new and complex regulatory landscape, which requires that insurers allocate resources toward compliance efforts.

This includes ensuring that digital platforms adhere to data privacy laws and industry standards, while businesses work to implement more advanced risk management tools to meet the risk management needs of the newly implemented digital environment.

.

Data is the Industry’s New Currency

At present, the global commercial insurance industry is shifting from traditional policy-driven models to more data-driven approaches.

This evolution is driven by advancements in data analytics, artificial intelligence (AI), and machine learning, which gives insurers the ability to enhance risk audits, personalize coverage, and improve operational efficiency.

There are four main ways in which companies are moving to digitization, all of which are accompanied by their own benefits and considerations. Some of these considerations include:

Telematics & Internet of Things (IoT)

Satellite & Climate Data

Social & Digital Data

Internal & Third-Party Claims Data

Benefits of a Data-Driven Insurance Model

There’s a reason why the majority of businesses worldwide are adopting new and emerging technologies and implementing them into their business frameworks: It works.

Businesses who choose to put in the initial investment for implementation, who make ongoing maintenance and monitoring a priority, and who acquire appropriate staff to oversee all of the above are the businesses that come out on top by Q4. Some of these benefits include:

Enhanced Risk Assessments

Personalized Coverage

Operational Efficiency

Fraud Detection

Challenges & Considerations

Despite the obvious advantages and benefits, the integration of big data and AI in insurance raises several concerns:

Privacy Issues

Bias & Discrimination

Regulatory Challenges

AI and Machine Learning are Revolutionizing Underwriting

There’s a reason why the majority of businesses worldwide are adopting new and emerging technologies and implementing them into their business frameworks: It works.

Businesses who choose to put in the initial investment for implementation, who make ongoing maintenance and monitoring a priority, and who acquire appropriate staff to oversee all of the above are the businesses that come out on top by Q4. Some of these benefits include:

Automated Risk Assessments

Predictive Modeling

Dynamic Pricing

Fraud Detection

Augmenting Human Expertise

Other Digitization Considerations

Digital Platforms & Ecosystems: Platform-based models are quickly being adopted by large and small enterprises alike. These digital platform models use a centralized digital infrastructure (often cloud-based) to facilitate interactions, transactions, and data sharing among different participants in the insurance value chain, with the first goal being to streamline policy administration, underwriting, claims handling, and customer engagement in one environment.

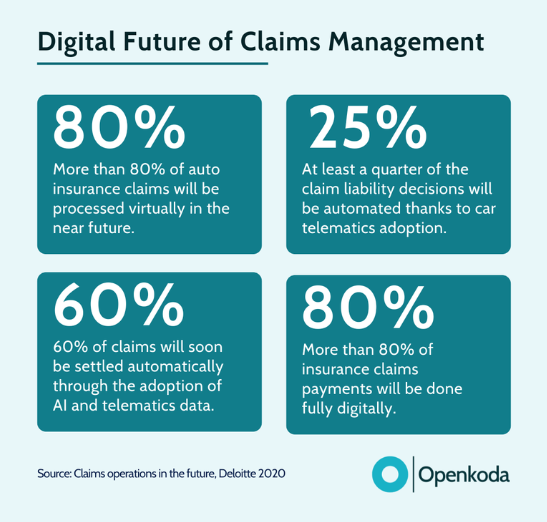

Claims Transformation: The claims process—traditionally slow and manual—is being transformed by digital innovation. Automated First Notice of Loss (FNOL) systems now allow instant claims reporting through digital platforms, often enabling policyholders to upload photos or videos directly from the scene of an incident. This speeds up the initial assessment and ensures insurers receive timely, accurate information.

Benefits of Digitization for Global Corporations: For multinational businesses, digital transformation delivers measurable benefits across their global insurance operations. One major advantage is centralized risk visibility, allowing corporations to monitor exposures, policies, and claims across multiple regions in real time.

Challenges & Limitations of Digitization: Despite its many advantages, digital transformation also brings major challenges for the global insurance industry. A key issue is data privacy and regulation. Compliance with frameworks such as GDPR, CCPA, and other national data protection laws restricts how insurers collect, store, and use data, making it difficult to balance innovation with compliance. These include Cybersecurity, Technology gaps and Human Expertise.

Looking Ahead: Digital Innovation in Insurance

Real-time insurance models

Premiums adjust dynamically based on live risk data

Example: Fleet insurance priced daily according to driving behavior

Embedded insurance

Coverage integrated directly into digital platforms

Example: Logistics or shipping software including automatic cargo protection

Parametric insurance

Automated payouts triggered by measurable data (e.g., earthquake magnitude, rainfall levels)

Benefits: Faster claims, greater transparency

Convergence of risk services and insurance

Insurers shifting from claim payers to proactive risk partners

Focus on continuous advisory support and prevention strategies using digital insights

Digital transformation & data-driven underwriting

Enables faster processes, deeper risk insights, and more personalized coverage

Represents a major shift in how insurance operates globally

Emerging challenges

Data governance

Cybersecurity

Balancing automation with human expertise

Get the WMB Difference

Need Help?

Contact Wilson M. Beck Global Risks to discuss how to protect your business - wherever it takes you.

Wilson M. Beck Global Risks Inc. is a boutique division of Wilson M. Beck Insurance Services, offering tailored insurance and risk management solutions backed by over 100 years of combined experience.

Our team delivers personalized service rooted in trust, collaboration, and genuine care, ensuring every client feels understood, supported, and confident in their protection.

Our specialization in multinational insurance and corporate risk solutions is designed for mid-sized to large organizations that demand personalized service, specialized expertise, and seamless execution – wherever your business grows.

Contact Wilson M. Beck Global Risks to find out more about how our team of global experts can protect your operations and help keep you resilient, compliant, and in business.

We Care. We Help.

Article References:

AI in Insurance Risk Assessment: What It Means for Insurance. (n.d.). Smart Choice. https://www.smartchoiceagents.com/tips/ai-insurance-risk-assessment-what-it-means-insurance

Decerto Blog | How an AI-Powered Underwriting Workbench Improves Efficiency in Risk Assessment. (n.d.). https://www.decerto.com/post/how-an-ai-powered-underwriting-workbench-improves-efficiency-in-risk-assessment

Insurity. (n.d.). Insurity survey finds only 15% of consumers prefer a fully digital insurance experience. https://insurity.com/press-release/insurity-survey-finds-only-15-consumers-prefer-fully-digital-insurance-experience

Naujoks, H., & Mueller, F. (2017, March 20). Digitalization in Insurance: the multibillion dollar opportunity. Bain. https://www.bain.com/insights/digitalization-in-insurance/

OpenKoda. (2025). Accelerating insurance digital transformation: 2025 outlook. https://openkoda.com/digital-transformation-in-insurance/

Prosci. (2025, August 7). Digital transformation in the insurance industry: A change management guide. https://www.prosci.com/blog/digital-transformation-in-insurance-industry

Rathi, N. (2024, September 19). AI risks making some people “uninsurable,” warns UK financial watchdog. Financial Times. https://www.ft.com/content/9f9d3a54-d08b-4d9c-a000-d50460f818dc

SePAC. (2024, November 20). Why traditional actuarial models are broken in cybersecurity insurance. SeCAP Inc. zX

Shah, S., Stephenson, D., & Waheed, N. (2021, March 9). Reduce, Replace, Rethink: Transforming Technology Costs. Bain & Company. https://www.bain.com/insights/reduce-replace-rethink-transforming-technology-costs/

Comments